A Simpler Approach to Retirement Planning for Advisors & Agents

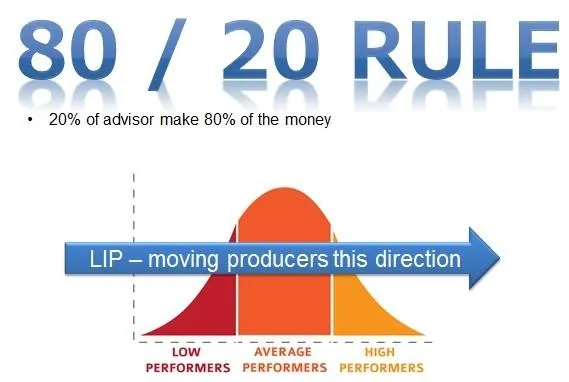

The Lifetime Income Process (LIP) is software combined with community that is designed to give advisors the tools they need to help clients build a clear, confident, and effective retirement strategy.

LIP simplifies your business, increases production, and increases referrals.

The Clarity Crisis In Retirement Planning

Every day, financial advisors face a frustrating challenge—helping clients truly understand what they need for retirement. You know the numbers. You see the gaps. But when you sit across from a client, the conversation too often turns into a confusing maze of projections, risks, and what-ifs.

Clients hesitate. They don’t get it.

They push back. They’re unsure.

They delay decisions that could secure their future.

It’s not your expertise that’s the problem. It’s the disconnect between what you know and what they understand. When clients don’t feel certainty, they stall, leaving you stuck in endless follow-ups and explanations—convincing instead of leading.

That’s why the Lifetime Income Process™ was built.

LIP combines a Non-Convincing Language philosophy with the most understandable retirement planning software on the market. The result? A process that simplifies the complex, builds trust faster, and gives both you and your clients the clarity and confidence needed to move forward.

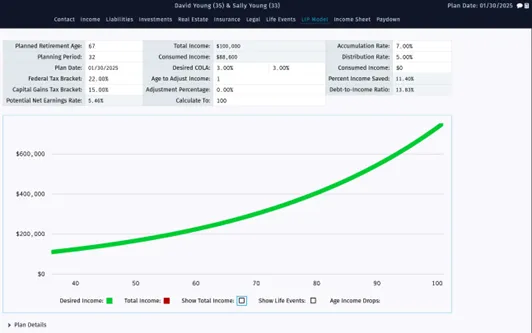

This graph's green line represents the ideal retirement—one where income steadily increases over time. Traditional advice suggests reducing income in retirement, but who wants to live on less as costs rise? Instead, retirement should provide an income that grows with inflation and your lifestyle—why not even get a raise when you retire?

LIP simplifies retirement planning by revealing a common reality—about 95% of tested plans show the red line dropping off the green well before age 90, often in the early 70s. This pattern holds true across all income levels and backgrounds. With just this simple graph, clients instantly feel the impact—no convincing required.

It really does change behavior and cause your client to take action!

We challenge you to put your clients’ data in the LIP software. What do their models look like? Are you 100% positive you have all

the needed information from your clients to give them a complete picture of their retirement outlook?

Lifetime Income Process

LIP IS RETIREMENT SOFTWARE + COMMUNITY & TRAINING!

LIP challenges the status quo of retirement planning and helps clients easily see and understand whether or not their

long term plan is in balance and on track to a secure retirement. It allows you to remove confusion for faster decision making.

Here is what is included with your LIP membership:

The Lifetime Income

Process Software

A revolutionary tool that transforms the way financial advisors approach retirement planning and client decision-making.

Shift from Needs-Based to Wants-Based Planning – Help clients move beyond basic survival numbers and envision a retirement that truly reflects their aspirations.

Drive Immediate Behavioral Change – Present information in a way that instantly shifts client perspectives, leading to faster and more confident decisions.

Powerful Financial Calculators – Quickly compute future value, present value, payments, rates, and time periods to provide precise and actionable insights.

Fast, Visual, and Understandable – Simplify complex financial concepts with an intuitive system that makes retirement planning engaging and easy to grasp.

Make retirement planning clearer, faster, and more impactful—giving clients the confidence to take action and advisors the tools to succeed.

All Features Included with Your Software:

LIP

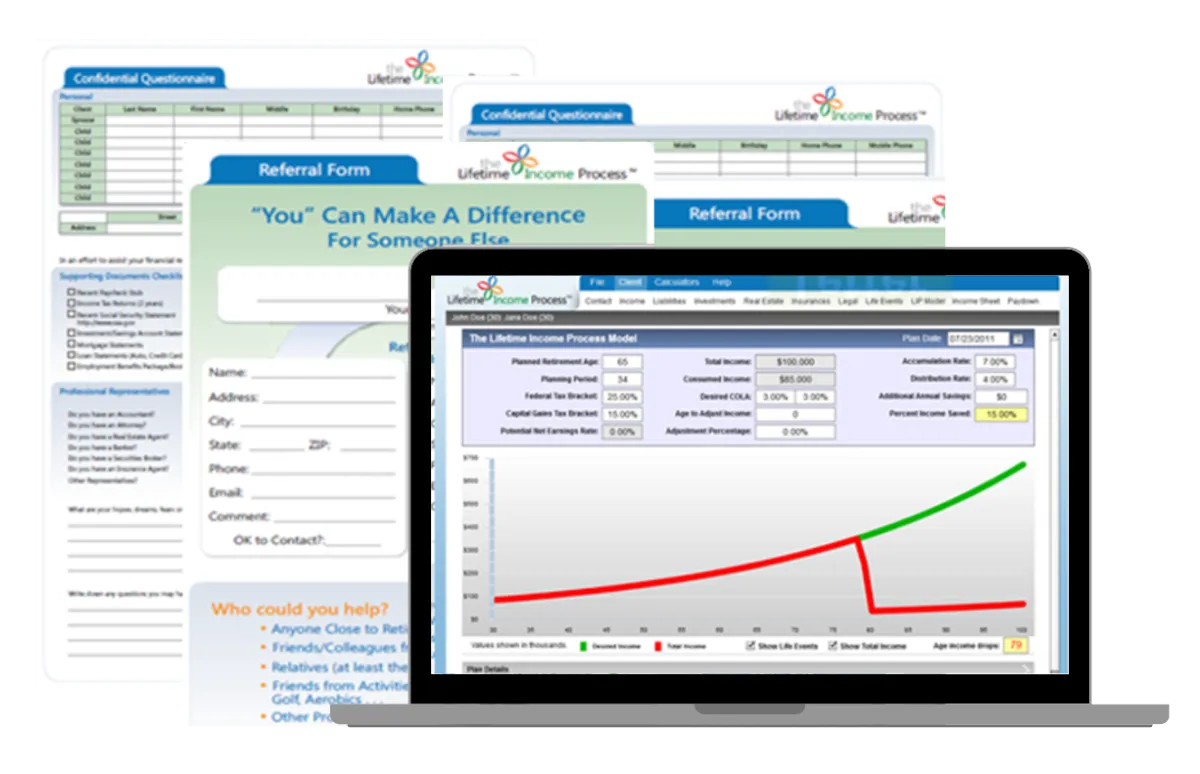

Materials

Essential tools to simplify client conversations and drive engagement.

-1 Page Fact Finder

-Opening Client Presentation

-1 Page Referral Guide

-And More...

LIP

Community

Ongoing support, training, and resources to help you master the Lifetime Income Process™.

-Live & On-Demand Training

-Practice Management

-Case Design & Product Knowledge

-Collaborative Learning

LIP Online

Training Course

A fully video-based training system designed for seamless learning and implementation.

-Complete Online Training Center

-Self-Paced, No Manuals

-Full Video Integration

-Comprehensive Training Library

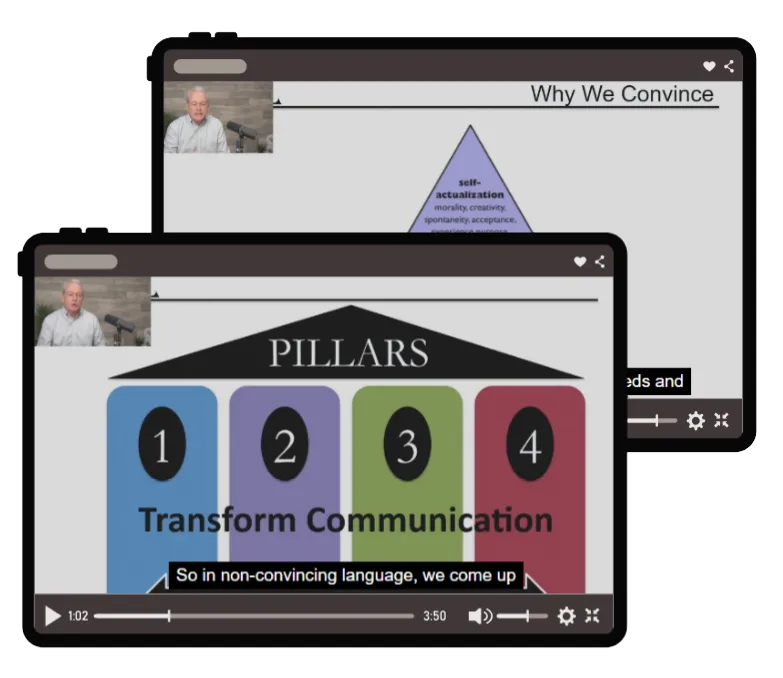

Non-Convincing Language Training

A powerful communication framework that makes selling effortless.

-Sell Without Convincing

-Master Key Financial Solutions

-Transform Communication

-Eliminate Sales Barriers

WHAT OUR CLIENTS SAY:

The Lifetime Income Process is a planning system that focuses on the truth. LIP shows clients and advisors the truth of a family's financial situation. It gives me confidence that we are giving the client the whole truth. It also gives me confidence that we are beginning at the right place to build a plan that helps the client achieve their goals. It gives the client confidence...they can see very clearly whether they are in great shape financially or whether they need to make changes. Either way (with LIP), we can show them very quickly the answer to keeping their plan on track or how to fix their plan without shoving a bunch of products down their throat. This puts clients at ease and also gives them hope, clarity and direction for their future.

This has changed my practice from the way I speak to clients, down to how I manage my practice. It gives me the confidence I need without being ‘salesy.’ We have one client in particular that once he and his wife saw the need for accuracy in their retirement planning, they scheduled an additional meeting to make sure they had the most accurate information to plug into the program. Our clients are appreciating the value this program provides.

The Lifetime Income Process gives the new advisor a great deal of confidence to know they can add genuine value to the client or prospect along with offering a uniquely simple approach the client easily understands. LIP has given our clients peace of mind and direction that can only be obtained by using this type of system. It never gets old hearing clients and prospects tell us: "This is what I was looking for;” This is "simple;” "I understand this!" Most comments are also accompanied by tears and laughter that comes only from these (LIP) meetings.

Randy T.

Pensacola, FL

Ed C.

Dothan, AL

Andrew M.

Pensacola, FL

LIP Membership is current discounted for the next 50 members.

Use coupon COMMUNITY to access the $97 price today!

Meet Our Team Of Professionals

David Anderson

Founder & CEO

David is the mastermind behind LIP, a highly successful financial professional from Pensacola, FL. Starting his career at age 9, he became a business owner at 17 and later served the U.S. Government for 17 years, managing national projects. In 2004, he transitioned to the financial industry, founding Nautilus Financial Strategies, LLC in 2007. David created LIP to help financial advisors easily duplicate his success. LIP has been used to develop over 2,000 retirement plans nationwide. His mission is to empower financial professionals passionate about helping clients achieve lifetime financial balance.

Randy Tyson

LIP Member Support

Randy, originally from North Carolina, joined Nautilus Financial Strategies, LLC after being a client of David’s for several years. With 17 years of experience in the retail furniture industry, including managing operations and multi-million dollar budgets, Randy now helps clients create healthy balance sheets through LIP. He focuses on retirement, income, long-term care, and legacy planning, providing a service and relationship that goes beyond transactions. LIP members can access Randy’s expertise in creating effective LIP models.

Alianna Lacombe

LIP Member Support

Alianna Lacombe is a dedicated member of the administrative team at Lifetime Income Process™. With a strong background in organization and client support, she ensures that operations run smoothly and efficiently. Alianna plays a key role in assisting advisors and clients, helping them navigate the LIP framework with ease. Her attention to detail and commitment to service make her an invaluable part of the team, ensuring that every interaction is seamless and professional.

Jereme Roodhouse

LIP Member Support

Jereme Roodhouse brings extensive expertise to the financial industry and to the LIP Community. With a deep understanding of protection planning, retirement income strategies, and legacy preservation, Jereme helps clients build financial security using the Lifetime Income Process™ (LIP). His approach goes beyond transactions, focusing on long-term relationships and tailored solutions that align with each client's unique goals. As a trusted resource for LIP members, Jereme provides valuable insights into optimizing strategies to create a strong financial balance.

STILL NOT SURE?

Frequently Asked Questions

Software - Community - Training

Question 1: How hard is it to get up and running using LIP?

You can literally be up and running in 1 day or less. The software is 100% video trained, so know big manuals to go through. You can have a pretty understanding and be able to build a basic model quickly.

Question 2: Does this software replace what I am currently using?

It could, but certainly does not have to. LIP was built to be your software platform or enhance your current toolbox. LIP can be used for basic data gathering and suitability concerns to full estate and retirement planning.

Question 3: What is Non-Convincing Language (NCL)?

A philosophy, rather than a technique, that will transform the way you communicate. We spend our whole life always trying to convince people of what we believe in or get approval of our position - validation. NCL helps to create real dialogue without the typical verbal jousting that most people experience.

Question 4: How do I learn Non-Convincing Language?

There are videos and podcast to watch and listen. And, we discuss language every week in our weekly training calls. That said, it will be a lifetime journey of working to have better communication in every area of your life.

Question 5: What is the LIP Community?

We strongly believe in people coming together, leaving their pride at the door, and having a desire to learn and share with one another. We desire to have a community of agents and advisors that want to have a larger impact on more people.

Question 6: How does the LIP Community meet?

We have live weekly training web-meetings in a style that is like having a pier study group available weekly. There is education on products, strategies, sales processes, language, estate planning and much more. There is also a community forum to share ideas and to post needed help.